Buying a home is a lifelong dream for many, and selecting the right home loan can make that journey smoother. As of September 2025, leading Indian banks are offering home loans at interest rates ranging from 7.35% to 10.75%, depending on the lender, loan type, and borrower profile.

This detailed guide helps you compare different banks’ offers, understand the factors affecting rates, and make an informed decision.

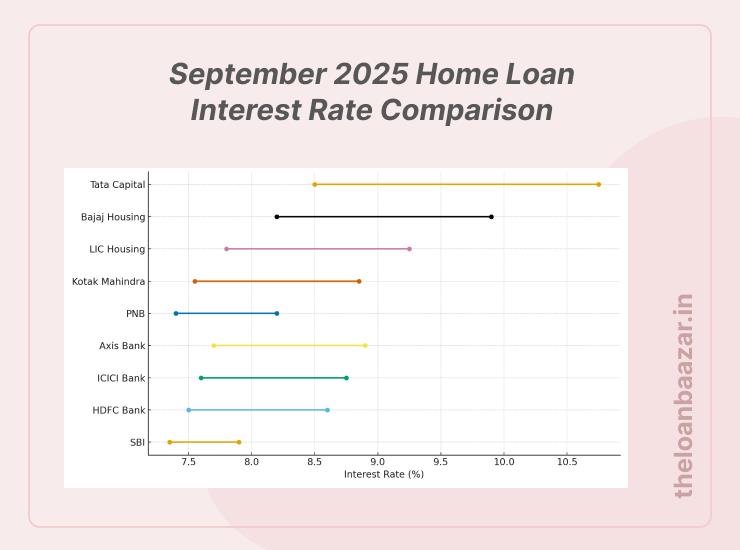

Current Home Loan Interest Rates in September 2025

Here’s a snapshot of what banks are offering this month:

- Public Sector Banks: Starting from 7.35% for salaried individuals.

- Private Banks: Ranging between 7.50% – 9.25% depending on credit profile.

- NBFCs & Housing Finance Companies: Offering slightly higher rates, up to 10.75%, but with flexible repayment terms.

September 2025 Home Loan Interest Rate Comparison

| Bank / Lender | Interest Rate Range (p.a.) | Loan Tenure | Processing Fee | Example EMI (₹50L, 20Y) |

|---|---|---|---|---|

| State Bank of India (SBI) | 7.35% – 7.90% | Up to 30 years | 0.35% of loan amt | ₹39,800 – ₹40,900 |

| HDFC Bank | 7.50% – 8.60% | Up to 30 years | 0.50% of loan amt | ₹40,100 – ₹42,900 |

| ICICI Bank | 7.60% – 8.75% | Up to 25 years | ₹3,000 – ₹5,000 | ₹40,400 – ₹43,400 |

| Axis Bank | 7.70% – 8.90% | Up to 30 years | 0.50% of loan amt | ₹40,700 – ₹43,900 |

| Punjab National Bank (PNB) | 7.40% – 8.20% | Up to 30 years | 0.35% of loan amt | ₹40,000 – ₹41,800 |

| Kotak Mahindra Bank | 7.55% – 8.85% | Up to 20 years | ₹3,000 onwards | ₹40,300 – ₹43,700 |

| LIC Housing Finance | 7.80% – 9.25% | Up to 30 years | 0.25% – 0.50% | ₹41,000 – ₹44,800 |

| Bajaj Housing Finance | 8.20% – 9.90% | Up to 25 years | 0.50% of loan amt | ₹42,300 – ₹47,500 |

| Tata Capital Housing | 8.50% – 10.75% | Up to 25 years | 1% of loan amt | ₹43,200 – ₹50,000 |

Insights from the Comparison

- Best Rates: Public sector banks like SBI and PNB are offering the lowest interest rates this September (starting from 7.35%).

- Flexibility: NBFCs like Bajaj & Tata Capital provide easier processing but at higher rates up to 10.75%.

- EMI Impact: Even a 1% difference in rate can save or cost you over ₹3,000 per month on a ₹50 lakh loan.

Factors Affecting Home Loan Interest Rates

- Credit Score – Higher CIBIL score = lower interest rate.

- Type of Employment – Salaried applicants often get better offers than self-employed.

- Loan Tenure – Shorter tenure may reduce the rate but increase EMI.

- Loan Amount – Larger loans might come with slightly different rate structures.

- Repo Rate & RBI Policies – Banks adjust their lending rates based on monetary policy.

Tips to Get the Lowest Home Loan Rate

- Maintain a CIBIL score above 750.

- Compare at least 3–4 lenders before applying.

- Opt for a floating interest rate if repo-linked rates are trending down.

- Negotiate with your existing bank for balance transfer benefits.

Benefits of Choosing the Right Home Loan

Lower EMIs save thousands annually.

Longer repayment tenure eases financial stress.

Tax benefits under Section 80C & 24(b).

Flexibility with top-up loan options.

Example EMI Calculation

- Loan Amount: ₹50 Lakhs

- Tenure: 20 Years

- Interest Rate: 7.35%

Monthly EMI = Approx ₹39,800

At 10.75%, the EMI jumps to around ₹50,000, showing why even a small percentage difference matters.

Q1. What is the lowest home loan interest rate in September 2025?

The lowest available rate is 7.35%, mostly from public sector banks for salaried individuals with good credit scores.

Q2. Can I transfer my existing loan to get a lower rate?

Yes, most banks offer home loan balance transfer facilities, allowing you to shift to a lender offering better rates.

Q3. Which is better—fixed or floating rate home loan?

- Fixed Rate: EMI remains constant but may be higher.

- Floating Rate: Linked to repo rate, usually lower in the long run.

Q4. Do NBFCs offer better home loan terms than banks?

NBFCs may offer easier approval and flexible documentation, but their rates are higher (up to 10.75%) compared to banks.

Q5. How can I apply for the best rate?

Compare offers online, improve your credit score, and negotiate with banks before finalizing.

Share via: